Credit cards have been around for decades but most card holders still aren’t completely sure about how they work. It’s important, though, because these little pieces of plastic are essential to the economy as well as our own lives.

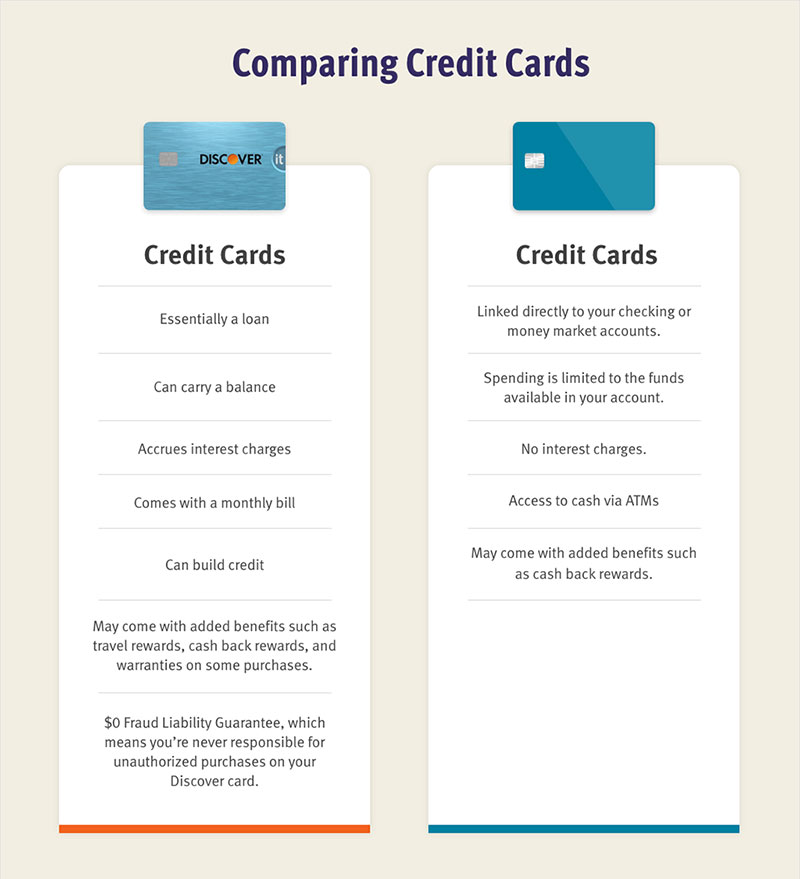

A credit card is essentially a method of payment that allows you, the cardholder, to buy goods and services based on a promise that you will pay for them later (within a fixed time frame). It sounds almost like a charge card, doesn’t it? But charge cards ask you to pay the complete balance every month on a specific due date, while credit cards let you maintain a balance of debt that’s subject to interest. They also involve a third party – in this case, the bank that pays the merchant for you and expects to be paid back.

Skipping the small print leads to big problems.

Most card holders skip the terms and conditions attached to their cards. Which is why they aren’t aware of the risks credit cards carry. The main problem is greedy companies that issue cards to people who shouldn’t be carrying them in the first place.

A 2015 article in The Guardian revealed the malpractice of giving cards to people who didn’t meet the financial criteria required to carry one. A 95 year old man was allowed to run up debts of more than £80,000 across 10 separate cards – in spite of having a monthly pension of just £1,200. The companies involved had a much clearer understanding of the poor man’s financial situation than he himself did – but they allowed it to happen anyway for their own benefit.

Choosing the right card

The modern economy functions largely on credit. That’s why there are so many different cards available, each claiming different benefits and promising different things. It can be confusing knowing which one is right for you. For instance, a travel rewards credit card will earn you airline miles, seat upgrades, access to exclusive airport amenities and more. But unless you’re a frequent traveler, you won’t have the opportunity to make use of the benefits. Retail rewards credit cards are great for people who shop frequently. They’re customized according to the kind of shopper you are. If you spend a lot of money on clothes, for instance, your card will provide reward points to encourage you to use it when you’re shopping for clothes shopping. First time credit cards are for students and young adults. They’re often designed to help people start building a good credit history but, of course, they will not help someone who’s been using credit cards for years.

Although there are many different card options, there are essentially two main types of credit cards: secured and unsecured. Secured cards require you to have a certain amount of money deposited in the bank. That money is what acts as security. Unsecured cards don’t require you to have a deposit – but they issue a limit on how much you can spend, based on your existing credit history.

Create a checklist

When you’re choosing a card, there are many things to consider so creating a basic checklist will be really helpful. Here are some of the things you should look at.

The Annual Percentage Rate (APR) to understand the actual cost of borrowing on the card if you choose to make payments over a period of time instead of clearing the balance each month.

The minimum repayment rate which is the smallest amount you need to pay each month (if you’re making your payments over a period of time).

The annual fee which is charged by some cards, as well as introductory interest rates that mean you either pay a low rate of interest in the beginning or none at all. (Don’t forget to check what the rates are after the introductory period is over.) Remember that the governments throughout Europe have introduced a number of rules and regulations to protect you from being taken advantage of. Be responsible, be aware of the terms and conditions, as well as your rights. And you will have nothing to worry about.